Development is the way to transform company from the current state to the future to-be state. One of the challenges in many portfolios is to focus too much on initiatives developing short term solutions: current products and offerings, existing processes and ways of working. Continuous improvement is super important, but if there is lack of development initiatives building future competitiveness, it is a good time to look if portfolio would need rebalancing.

I will review here some models for mapping your portfolio content based on the different horizons:

McKinsey Three Horizons model

McKinseys Three Horizons model introduced in The Alchemy of Growth (Bahai & Coley, 2000) divides investments into three horizons:

- Horizon 1 – focus on growing and defending a company’s core businesses to ensure near-term success. Investments are typically well known and there is a low uncertainty. This is a kind of comfort zone for many portfolios – examples of investments could be enhancing existing products and offerings and improving current operating model, and IT systems.

- Horizon 2 – investments are focusing on scaling new revenue streams, perhaps a bit outside of core offerings with higher investments and longer investment horizons than in horizon 1. New capabilities needs to be built to support horizon 2 investments.

- Horizon 3 – investments in horizon 3 have high level of uncertainty, high level risk, and often high level of research and development required. These development initiatives could lead to creation of completely new markets for company – and potentially there could be a very high profits available in the future.

Investments into horizon one feel safe – this the comfort zone for many of us – we know this staff well and there is not so much risk. However, if all investment money is spent in Horizon 1, your portfolio may be already late with your Horizon 2 or Horizon 3 investments – too much investment into short term may damage future competitiveness. Some companies have a practice to create own portfolios for Horizon 2 or Horizon 3 investments – to give an own investment bucket for forward looking initiatives.

SAFe Investment Horizon Model – Guiding Investments by Horizons

Scaled Agile Framework has also adapted three horizons model with some enhancements. In addition to horizons 1-3, also Horizon 0 for retiring products and solutions was added – this is good, as it is important to also decommission old solutions. Horizon 1 is also split into two categories: Investing and Extracting solutions. Horizon 2 solutions are emerging next generation horizon 1 products, where as horizon 3 is focusing on new opportunities with longer return of investment time.

Categorizing investments into different horizons is a great tool – as a one time effort or even by adding horizon into your portfolio data.

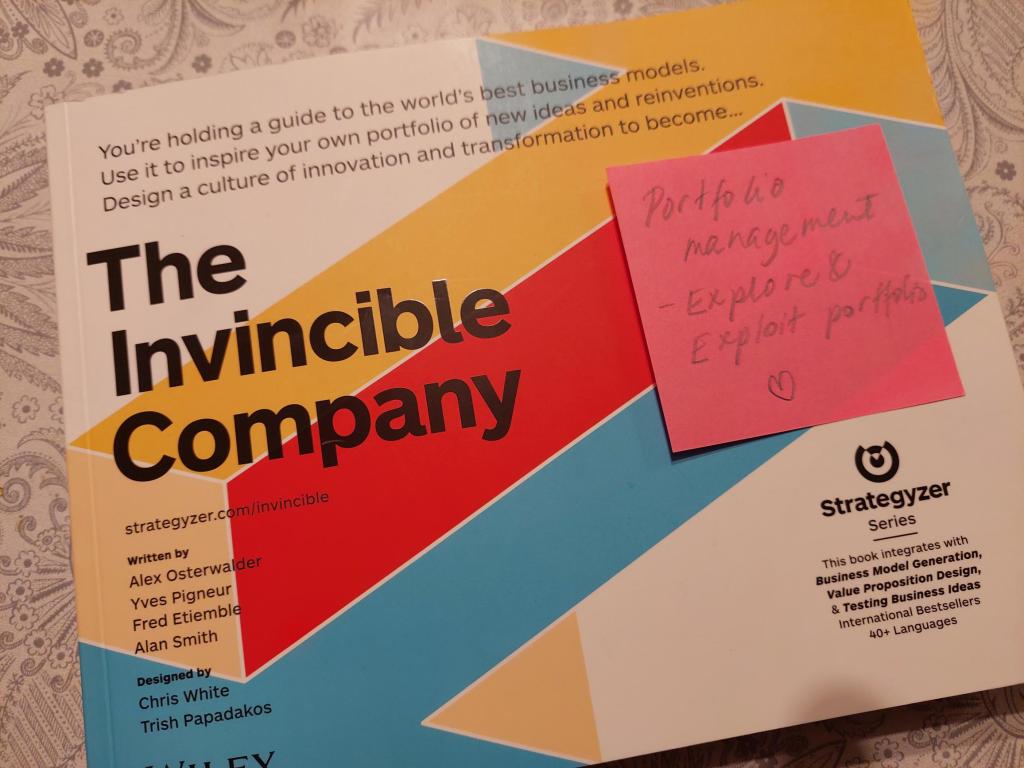

Exploit and Explore Portfolio by Strategyzer

The idea within Exploit and Explore Portfolios by Strategyzer’s The Invincible Company is to divide portfolio into products, offerings or solutions belonging to either Explore or Exploit portfolios.

Within Explore portfolio, there are new initiatives, perhaps belonging to Horizons 2 and 3. Items are mapped based on the Expected return and Innovation risk – a visual tool to map the different products and services.

Within Exploit portfolio, there are existing products and solutions – perhaps Horizons 1 and 0 might belong here. Items are mapped here based on Return and Death & Disruption risk.

For product portfolios, also product life cycle stages are commonly used tool to balance product portfolio across Development, Growth, Maturity and Decline stages.

Key takeaways – is your portfolio balanced across time horizons?

A good practice for any development portfolio is to check when doing long range planning or yearly budgeting work, how much money you are spending on each time horizon. This is a good agenda item to be also discussed during the quarterly review (See my previous post – Time for a quarterly portfolio review?) If you do not have this information gathered in your portfolio data, this can be done as one-time analysis for example yearly.

Also in enterprise level, this is a good exercise to look into as part of the strategy implementation – how much are our development portfolios spending on developing Exploit portfolio or Horizon 1 and 0, and how much are we investing into future competitiveness?

The balance between different time horizons depends on each portfolio vision, as well as company strategy and risk tolerance.

References

Baghai, Mehrdad, and Steve Coley. The Alchemy of Growth: Practical Insights for Building the Enduring Enterprise. Basic Books, 2000.

Scaled Agile Framework (SAFe) – Lean budgets / Guiding investments by Horizon

One thought on “Is Your Development Portfolio Balanced Across Different Time Horizons?”