Development portfolio governance is one of the areas, which might cause headache in in many organizations. I wanted to have a look at the what standards say about the good governance, and reviewed briefly ISO 37000 – Governance of organizations standard focusing on governance principles. The standard may be applied for any type of organizations, and I think the guiding principles are also good food four thought for portfolio governance.

Primary governance principle – Purpose

Primary governance principle in ISO 37000 is the Purpose – there needs to be a clear purpose why organization exists and the same applies also for development portfolios. What is the purpose of the portfolio? What is the reason of existence from different perspectives?

Clear purpose statement defines, specifies and communicates the value the portfolio intends to generate for specified stakeholders. Clear purpose is really important: to be able to communicate the purpose & WHY portfolio exists.

Supporting questions:

- Have you defined a purpose for your development portfolio?

- Have you communicated about the purpose with different stakeholder groups?

4 Foundational Principles – Value Generation, Strategy, Accountability and Oversight

Next, standard defines 4 Foundational Principles. Let’s look into those, too.

Value Model – the elements comprising value creation and value generation which are required to fulfil purpose. Value generation model provides basis for innovation and also for collaboration with the stakeholders.

Supporting questions:

- What value is the development portfolio creating to customers, business, organization, and even in a wider context to other stakeholders?

Strategic development portfolios should be by definition, strategy driven. One of the foundational principles for governance is Strategy – engaging strategies in accordance with the value model.

Supporting question:

- Is your portfolio strategy driven?

- What does the company strategy mean in practice for your development portfolio?

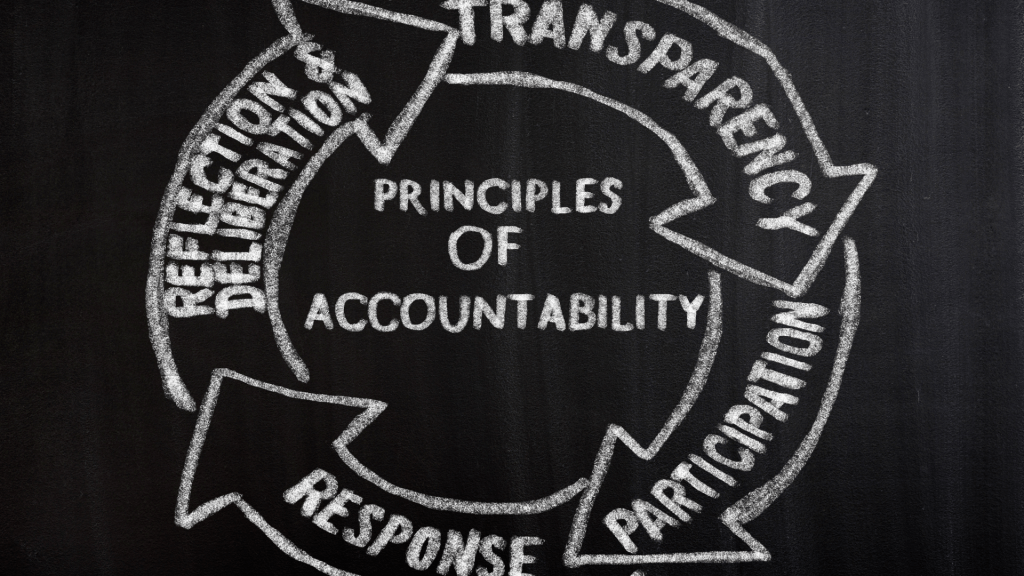

Accountability – Accountability engenders trust and legitimacy, which leads to improved outcomes. Those responsible for managing the portfolio must be held accountable for their actions and decisions. This includes ensuring that there are clear lines of responsibility and authority, as well as systems for monitoring and evaluating performance.

Supporting question:

- Are the roles defined clearly for your portfolio, so that accountable members know their responsibilities?

- Do you systematically create transparency across the stakeholders on your development portfolio progress and plans?

- Do you actively engage stakeholders?

- Do you collect feedback and improve ways of working systematically?

The Fourth Foundational Principle Oversight is important to ensure the governance is appropriately designed and operating as needed. This principle is overseeing portfolio performance and enduring portfolio is fulfilling the expectations. As a good practice, there is an internal control system implemented for oversight.

Supporting questions:

- Do you have a definition for your portfolio governance model available for different stakeholders?

- Are the stakeholders aware of your governance model?

- Are you following up, that governance model is used in practice? What happens, if there is an exception?

- Do you have clearly defined guardrails for financial decision making and internal control system it is followed?

6 Enabling Governance Principles

ISO 37000 standard includes also 6 Enabling Governance principles: Stakeholder engagement, Leadership, Data and decisions, Risk Governance, and Social Responsibility. I will review also these in the context of development portfolios!

Stakeholder engagement – Member, reference, and relevant stakeholder engagement are key. Transparency is a key element of effective governance, and stakeholders must have access to information about the organization’s goals, strategies, and performance.

Supporting questions:

- Who are your development portfolio key stakeholders?

- How do you engage with the different stakeholder groups?

- Do you create transparency on development portfolio plans, progress and outcomes?

- Are you meeting the expectations of different stakeholder groups?

Leadership – The governing body should lead by example to create a positive values-based culture, set the tone for others, and engender trust and mutual cooperation with the organization’s stakeholders. Effective governance requires strong leadership, with clear roles and responsibilities defined for all stakeholders involved.

Supporting questions:

- Are you leading by example?

- Is the portfolio decision making ethical?

- Is the portfolio decision making efficient?

- Are you creating an positive environment, building trust and good cooperation with the stakeholders?

- Are you following company leadership principles also in the context of the development portfolio?

Data and decisions – The governing body should ensure that the organization identifies, manages, monitors and communicates the nature and extent of its use of data.

Supporting questions:

- Is your portfolio data up-to-date, e.g. the project schedules, approved budgets and business cases?

- Do you use actively data in the portfolio decision making?

- Do you maintain presentation materials and meeting minutes for the portfolio governance body?

One of the goals of portfolio management it to maximize the portfolio value – this also requires taking some risks. Governance is not just about compliance. It is about managing risk in a way that ensures the long-term success of the organization.

Risk governance – Value is generated when appropriate risk is taken, transferred or shared in a timely manner. This happens when the governing body balances risk effectively.

Supporting questions:

- Are you reviewing portfolio risks regularly?

- Do you have clear practices, for mitigating risks and reporting risks?

- Are you balancing the risks?

The guidance explains what good governance looks like across eleven mission critical topics:

Social responsibility – The organization should proactively contribute to sustainable development by generating value in a manner that meets the needs of the present without compromising the ability of future generations to meet their own needs.

Supporting questions:

- Are the decisions made ethical and considering also the social responsibility?

Viability and performance over time – portfolio should ensure viability over the time without compromising current and future generations.

Supporting questions:

- Are the decision made today enabling also the future success?

- Is portfolio balanced across time horizons?

By following these principles, developmen portfolios can enhance decision-making processes, manage risk more effectively, and achieve long-term success.

One thought on “Principles of Good Portfolio Governance”