Strategic portfolios are looking into opportunities related to Mergers and Acquisitions (M&A). Big Mergers & Acquisitions may have significant impacts on development portfolios – even redoing the development plans totally. M&As tend to come as a surprise, as there are strict regulations on how to handle such sensitive information. Let’s review some of the common M&A scenarios from the development portfolio view point.

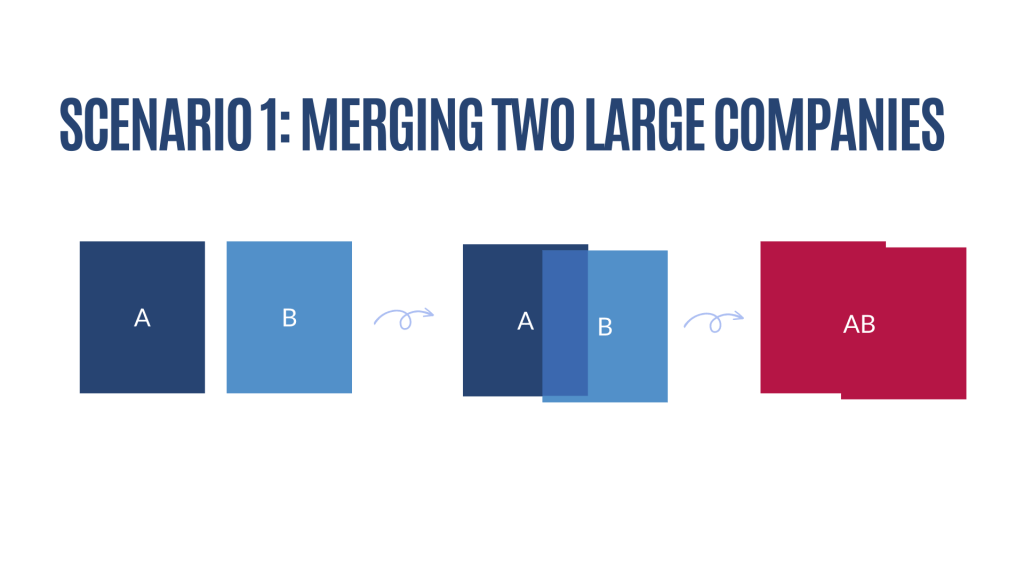

Scenario 1: Merging two large companies

This is a really big deal! Merging two big companies has huge impacts on development portfolio plans and structure, data, and tools, organization, ways of working, and even company culture. Also completing the merge may take even several years, if there is a lot of overlap.

Here are a few things to consider from a development portfolio viewpoint:

- Uniting development portfolios over time, or keeping separate portfolios?

- Keeping different brands or uniting the brands?

- Selecting which product lines to continue, and which should be ramped down over time – not an easy task, especially, if some of the product lines are overlapping.

- Are customers and customer segments overlapping, or creating synergies – are there new opportunities to create end-to-end value towards customers? How about business models and way to sell towards customers?

- Business processes and operating model – area with endless opportunities, but also a lot of complexity due to differences in the businesses.

- Finding synergies from IT tools, migrating data, ramping down parallel systems, and integrating systems and processes. Big companies may have thousands of applications, and even this IT stream may be a really big thing!

- Ways of working – a significant change management and training may be required, if companies have different ways of working, for example the use of lean and agile vs. traditional ways of working.

Scenario 2: Merging a smaller company

A common scenario familiar to many – a bigger company buys a smaller company to acquire new products or services, technology, or other capabilities.

Here are a few things to consider from the development portfolio viewpoint:

- M&A is often a must-to-do – do we need to change priorities in our development plan to support M&A activities?

- Are there overlapping products, services, and offerings?

- How closely should the smaller company be integrated? If there is a strong company way operating model, deployment of the common processes, tools, and way of working may require a lot of effort for example from IT units, but also from the business process view point.

- There may be a need to rollout also corporate ICT and core solutions, such as ERP and CRM for the unit.

- Building a roadmap for all needed changes may be required.

- Will the newly purchased business unit have its an own development portfolio, or will development be part of one of the existing portfolios?

Scenario 3: Integrating a new unit fully into the main business

This scenario may happen years after the original M&A. Business has grown, and opportunities to bring the acquired business unit closer to volume businesses may require full integration of operating model, ways of working, and also different systems and tools.

Topics to consider:

- Requires full integration of organization, processes, ICT, and IT solutions, as well as products, services, and offerings – maybe even a dedicated transformation program to ensure smooth change management.

- Merging also development portfolios together, and aligning ways of working and priorities.

- How to keep the strengths of the unit to be integrated, while also getting the benefits of closer integration? Should something change also in the main businesses?

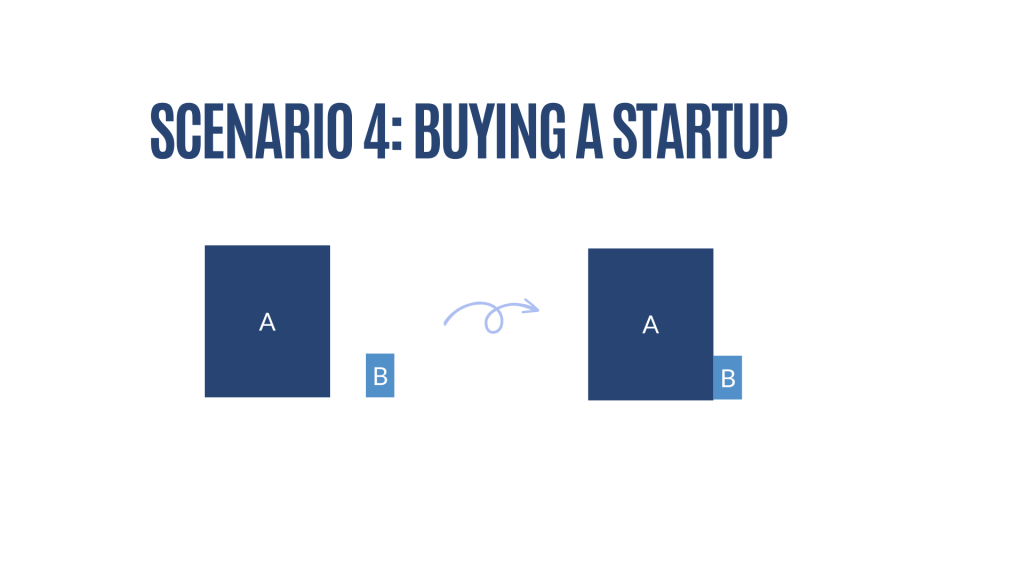

Scenario 4: Buying a promising start-up

Buying a start-up is a great way to get new competencies to the company. Often also start-up strength is the agility and possibility to pivot different types of opportunities quickly, whereas established companies have their scalable processes and ways of working.

Things to consider for development portfolios:

- What is the end goal for the start-up – integrating into the main company and scaling the offerings, or continuing as a start-up within a corporation?

- If the start-up approach is selected, the start-up may continue to manage development portfolios as previously, with strategic alignment on corporate development portfolios. There may be a conflicts between the cultures, and ways of working.

- In a long run, when scaling up is required, there may be a need to integrate the start-up closer to the corporation and also merge development portfolios.

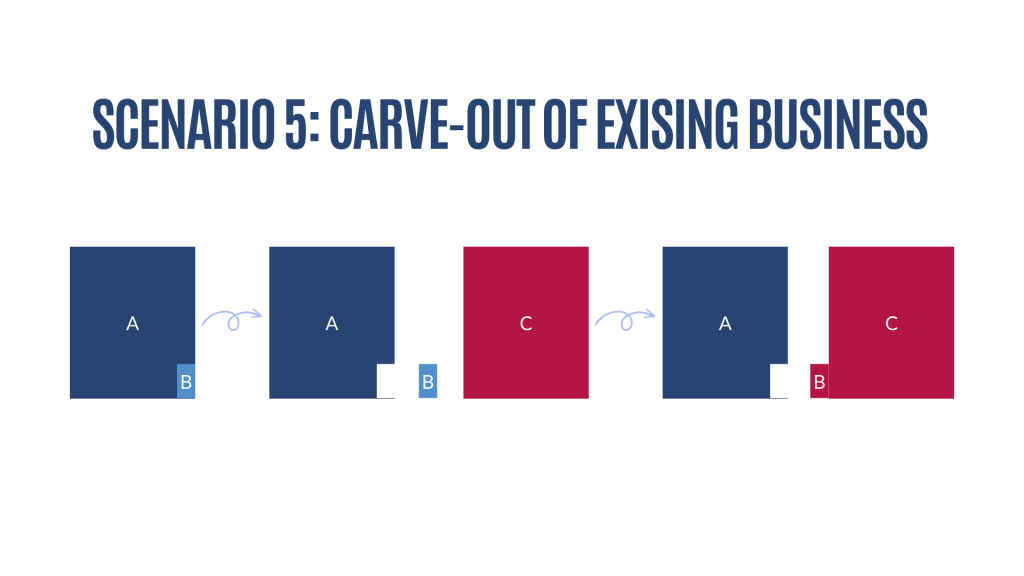

Scenario 5: Carve out of existing business

This is also a rather common scenario – part of the business no longer fits well to company strategic targets, and there is another company, which is looking for such a business opportunity! Optimally, this is a win-win situation for all parties!

When one of the business units or parts of the business is sold out, there are impacts on the development side too.

- Organization – a big change for the people impacted!

- Data, ICT & IT systems – the transition of all IT to the buyer and cleaning up also the data from the corporate systems – may be a big and complex effort.

- Is the change impacting also development portfolio priorities?

This is again one of those areas, where I would love to learn more! If you have good learnings to share, I love to catch up!