Why do so many products fail despite great ideas? Often, the missing link is a clear, actionable product strategy. A good strategy isn’t just a roadmap – it’s a set of choices that connect vision to customer value and business outcomes. But how do you get it right? I will summarize both my own practical learnings and also add plenty of inspiring additional reading links below! As always, I hope this is helpful, and I would love to hear your thoughts, too!

Building ambitious and inspiring product vision

The first mindset shift needed is moving from day‑to‑day operational or tactical thinking toward a more strategic perspective – starting with your product vision. Ask yourself: Do you already have an ambitious product vision? Has it been created together with your team and aligned with management?

Below are a few practical tools that can help you define and strengthen your vision:

- Your North Star – What is the ultimate aspiration or desired long‑term outcome for your product?

I’ve written about this earlier:

https://strategic-portfolio-management.com/2023/08/05/finding-your-north-star-creating-a-shared-long-term-vision/ - Bright Future Ahead – What does a compelling future look like for your product?

Read more here about the Bright future method which I have learned from my earlier colleague Mirette Kangas:

https://strategic-portfolio-management.com/2023/01/02/bright-future-ahead-creating-an-inspiring-development-portfolio-vision/

Whichever method you choose, define an ambitious and inspiring product vision—one that energizes your teams and guides strategic decisions.

Objectives and Key Results – Step-by-Step Path Towards Product Vision

One of my favorite tools for goal-oriented management is the Objectives and Key Results (OKR). It integrates well into a product strategy approach by helping you to set clear, step-by-step objectives and measurable key results that lead you toward your future vision.

The idea with OKRs is simple: we define inspiring objectives and concrete measurable key results. Sounds easy, but defining great OKRs requires some work and typically a few iterations with the team and key stakeholders. Over time, OKRs become better and better!

For more on OKRs, here’s an earlier blog post with helpful links:

https://strategic-portfolio-management.com/category/objectives-and-key-results/

Where to Win and How to Play?

When you are developing your product strategy, DO NOT FORGET YOUR CUSTOMER!

Product strategy must be grounded in customer insights – understanding the real needs of customers.

- Based on customer feedback, what insights do you have for the future needs of the customers?

- Are you actively ideating with customers and validating new ideas with the customers?

- What is your product’s key value proposition towards customers? Can you summarize shortly how your product creates value for customers?

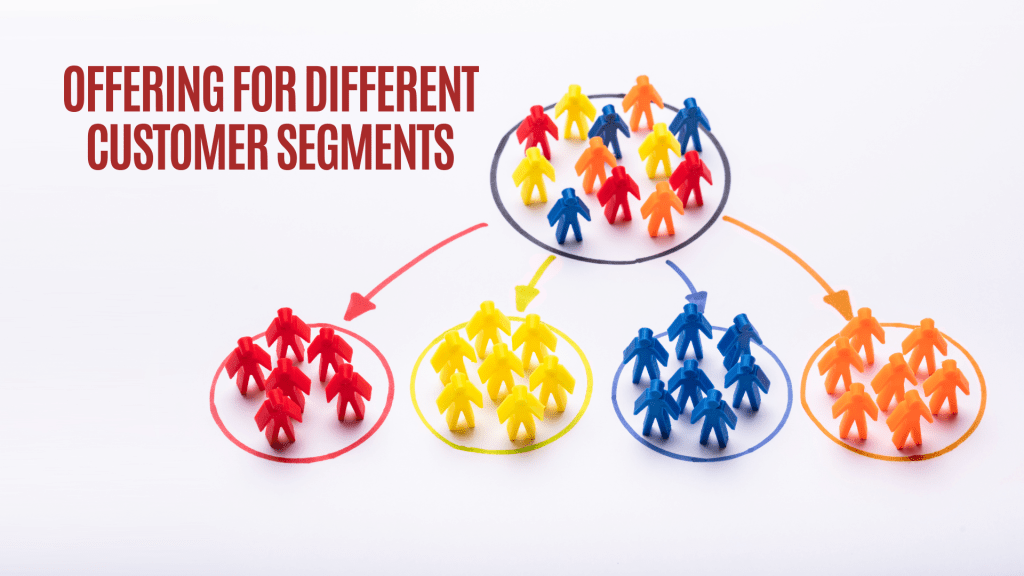

- Do you know your key customer segments – where do you want to focus efforts?

- How are markets evolving? What alternatives or competition do you have in the markets?

- How is your global supply chain looking like considering different geographical locations? Do you have different customer needs in different regions?

- How is the regulation changing? Do you have some compliancy requirements to consider?

- How about the strategy for the company or business unit? Do you receive new direction regarding the product focus areas from this strategy?

This is one of those topics, which for sure would deserve fully dedicated blog post…

Building an Outcome-Based Strategic Roadmap with Different Time Horizons

What is the first thought when you think about product strategies? For many of us, it may be a product roadmap illustrating where we are heading with the product and what developments are ongoing.

I have seen many wonderful product roadmaps, and here are a few options to consider:

- Build an outcome-based roadmap – instead of showing project stages or milestones, show what the tangible concrete outcomes of development activities are.

- Show different time horizons – build your roadmap utilizing different time horizons. For example, you could have a detailed roadmap for the next quarter or year, but less detailed business epics for the next five years.

- Build your roadmap based on strategic themes – group development activities based on strategic themes, to link the work to company or business unit strategy implementation.

- Utilize common roadmap templates – check with your colleagues, if they already have great templates or examples, you could utilize for your product roadmaps. If every product manager in a company builds the roadmap in a different way, think about the headache for senior management trying to see the big picture.

- Utilize company portfolio management tools – portfolio management tools today offer possibilities to create different types of views and visualization based on the entered data. If you have a tool available, could you utilize that to create portfolio level transparency?

- Share your roadmaps with the stakeholders – If you do not have common tools, would you have a common location where to store and share product roadmaps? If your product roadmaps cannot be openly shared across wider group of stakeholders, do you have regular meetings where you share the updated roadmaps with the management?

Building a great product roadmap typically requires several iterations – you may need to collect feedback from different development teams and numerous stakeholder groups – and based on all of the feedback received, you can improve your product roadmap. Just remember to utilize your product roadmap actively as a part of day-to-day work when you meet different stakeholder groups!

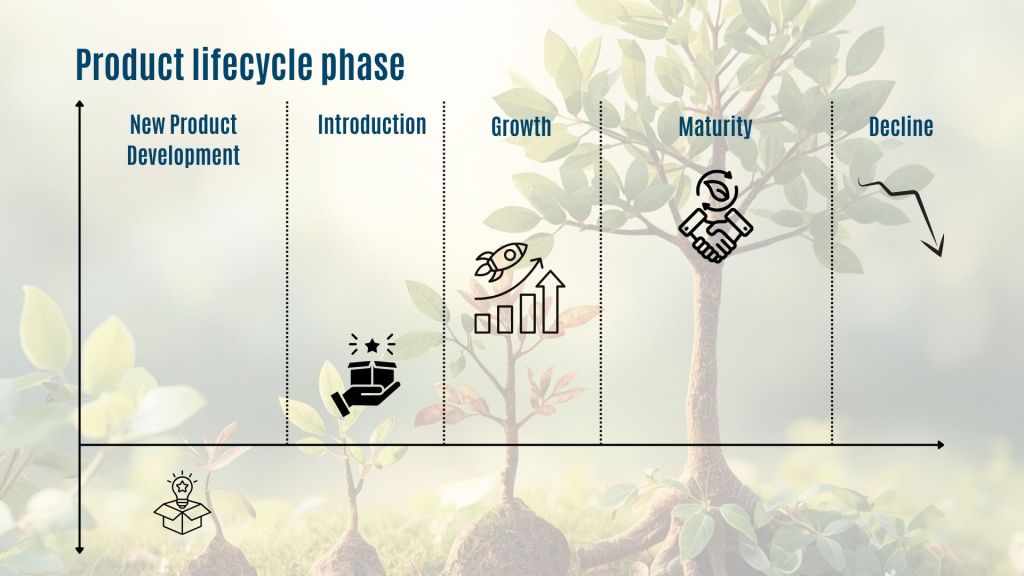

What is the lifecycle phase of your product?

Product strategy depends a lot on the lifecycle phase of your product. I have noticed that for a wider group of stakeholders, it is not necessarily clear that everyone shares the same understanding of the stage. Sometimes, a product may still be in pilot as part of New Product Development, but there is an expectation of already reaching growing volumes. Your organization may have its own categorization for product portfolio management, but here is a generic one with phases: 1) New Product Development, 2) Introduction, 3) Growth, 4) Maturity, 5) Decline.

Here are few topics to analyse:

- In which lifecycle phase is your product currently? You can also use volumes and sales statistics to analyze this if it is not fully clear, and have an open discussion with the team and stakeholders.

- Are you moving towards next phase and do you need to take actions to prepare for the next phase? For example if you are moving from New product introduction to Growth phase, do you have scalable service processes in place to support growing volumes?

- If you are looking at the product portfolio, how does the overall status of different products look like? Do you have gaps in your portfolio?

- Are you familiar with Strategyzer’s Explore and Exploit portfolio? Good content piece to check out available here: https://www.strategyzer.com/library/business-model-evolution-using-the-portfolio-map

Share your product strategy to build alignment and feedback loop

If you create a great product strategy, but only a few people know about it – product strategy creates little value. So be brave and share your product strategy with the stakeholders – it may feel very uncomfortable especially during the first rounds, but it gets easier over time.

- Implement feedback loops – product strategy should evolve with market shifts, technology changes, and based on customer feedback. What is the good cadence for you to look into product strategy? Quarterly? Bi-yearly? This depends a lot on what type of product you are working with.

- Our teams have had good experiences with product strategy days with the key stakeholders and strategy communication towards larger audience.

- Customize communications content based on the audience – Sometimes it is a good to remind myself, that not everyone is deeply involved in our product development, and you may need to have communications materials with different abstraction levels. If you have a master comms materials, pick and choose relevant content to meet the needs of your audience.

What are your pro tips? I would love to hear what has been working well for you!

For more inspiration – additional reading

There is a lot of really good content about product strategies, here are few examples I have felt were inspiring:

Aha! (2025). Product strategy: How a clear one leads to success. https://www.aha.io/roadmapping/guide/product-strategy

Amplitude. (2024). What is a product strategy? Framework, template, and examples. https://amplitude.com/blog/product-strategy-framework

Atlassian. (2025). What is a product strategy? Definition, best practices & how to build one. https://www.atlassian.com/agile/product-management/product-strategy

Design2Market. (2024). Product strategy demystified – No MBA required. https://www.design2market.co.uk/academy/product-strategy-a-step-by-step-guide/

ProductPlan. (2024). What is a product strategy? https://www.productplan.com/glossary/product-strategy/

Remote Sparks. (2025). 10 essential product strategy frameworks for 2025. https://www.remotesparks.com/product-strategy-frameworks/

Scrum.org. (2025). What is product strategy? How to think and act strategically as a product leader. https://www.scrum.org/resources/blog/what-product-strategy-how-think-and-act-strategically-product-leader

Walker, S. M. (2024). Product strategy guide — Templates/Frameworks (2023 Edition). https://productstrategy.co/the-ultimate-guide-to-product-strategy/